No Deal Brexit – The Prediction for Rugby House Prices

Roll the clock back to April 2020, and major financial economists and property market commenters were sounding the alarm. The very best-case scenario was a 5% drop in property values by the end of the year, and most were in the 10% to 15% range. They forewarned the Covid-19 stimulated recession would trim tens of thousands of pounds off the value of Rugby homes.

Yet the Rugby property market seemed not to get the memo on that, and now as we find ourselves at the end of 2020 and the worst of lockdown restrictions appear to be passed, vaccinations on the way and economy starting to grow, Rugby property prices seem to be doing quite well.

What happened to the Rugby house price crash that wasn’t?

Before I answer that, it reminded me of what the Treasury said in 2016 about a leave vote on the Brexit referendum. The considered opinion of the Treasury was house prices would drop by 18% if the country voted to leave the EU, so let us see what that would have done to Rugby house prices if that had taken place and then what exactly has happened in the last four and half years …

| Average Value 2016 | Predicted Drop by The Treasury because of Brexit | Average Value Today | Uplift in Value in Last 4.5 Years | % Increase since Brexit Vote | |

| Rugby Detached | £296,700 | £243,300 | £356,900 | £60,200 | 21.3% |

| Rugby Semi | £195,200 | £160,100 | £211,700 | £16,500 | 7.5% |

| Rugby Terraced / Town House | £145,700 | £119,500 | £170,200 | £24,500 | 17.8% |

| Rugby Apartments | £109,400 | £89,700 | £131,800 | £22,400 | 19.5% |

So why has the Rugby property market not matched the property pundits twice in the last five years or so?

Well for most of us, owning a property is about having somewhere to live rather than an investment (an Englishman’s home is his castle??). Nevertheless, once a homeowner is on the proverbial ‘property ladder’, it cannot be denied that it is eternally beneficial to know, as a homeowner, that you have made a healthy investment in your home and that the value will rise to alleviate the ache of trading up market — or down market when you retire.

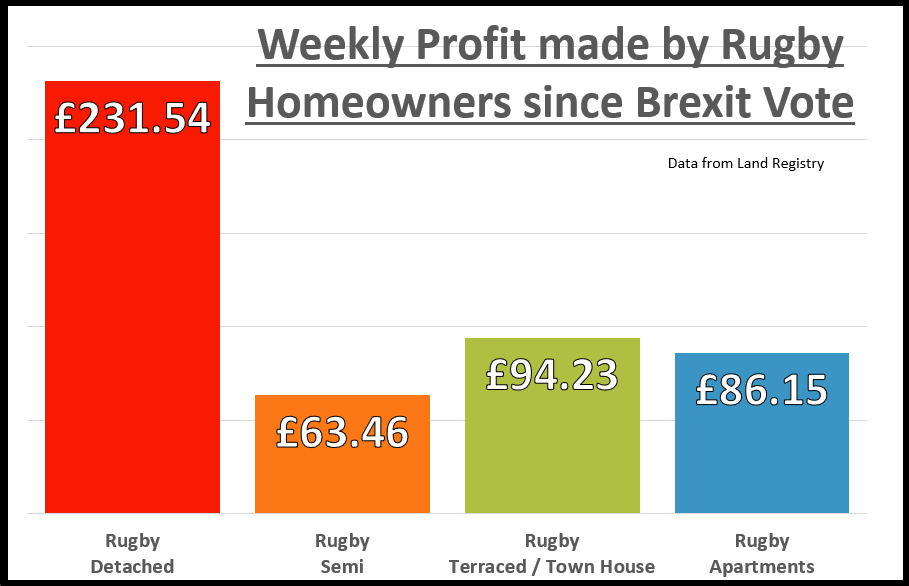

Those Rugby homeowners who own detached homes would have made an average of £60,200 profit, a rise of 21.3% or a weekly profit of £231.54 — calculated between the price they would have paid in the summer of 2016 and the price they would sell for today. Looking at the weekly profit for all property types in Rugby since the Brexit vote …

- Rugby detached homes weekly profit of £231.54 per week

- Rugby semi-detached homes weekly profit of £63.46 per week

- Rugby terraced homes/town houses weekly profit of £94.23 per week

- Rugby apartments weekly profit of £86.15 per week

Whilst it is no surprise the property market boom was inspired by the Chancellor’s Stamp Duty holiday, this is not exclusively the Chancellor’s achievement. The three ‘D’s have been with us throughout 2020, Covid or no Covid (Debt, Divorce and Death), together with a huge shift in the way Rugby homeowners see their homes. With us cooped up during the lockdown and working from our dining room tables, the want and need of Rugby people to have a home with an extra bedroom to work from, together with a garden has been one of the most challenging this year… hence the rise in demand.

So, what of 2021? It’s true that the country will have high unemployment, yet at the same time, we have ultra-low interest rates and for the last 20 years, on average we have only built 150,000 households per year as a nation, but needed 300,000 per year to keep up with immigration, people living longer and changes in the way households are made up (compared to the Millennium).

Many people can predict what will happen – yet none of us really know what will actually happen to the Rugby property market in 2021.

Covid was a black swan event and the fallout from that, I believe, has changed Rugby peoples’ lives and their lifestyles, especially how they see their home. Instead of making predictions, nothing can get away from property market fundamentals, which have driven price booms on the back of high demand for homes and low supply (i.e. properties coming onto the market) and price crashes on the back of over-supply and low demand. Only time will tell if, in 2021 the Rugby property market will see a flood of properties coming to the market because of debt or the demand for larger homes continues to rise unabated.

Please do let me know your thoughts on the matter.

<